OPTIONS PREMIUM

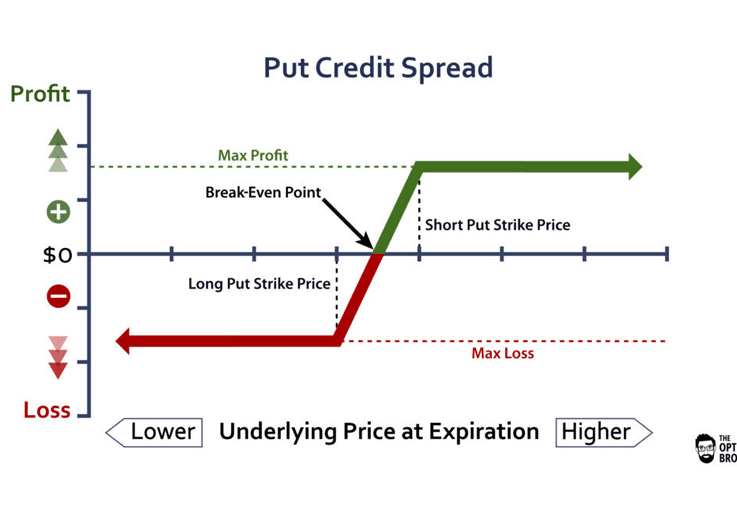

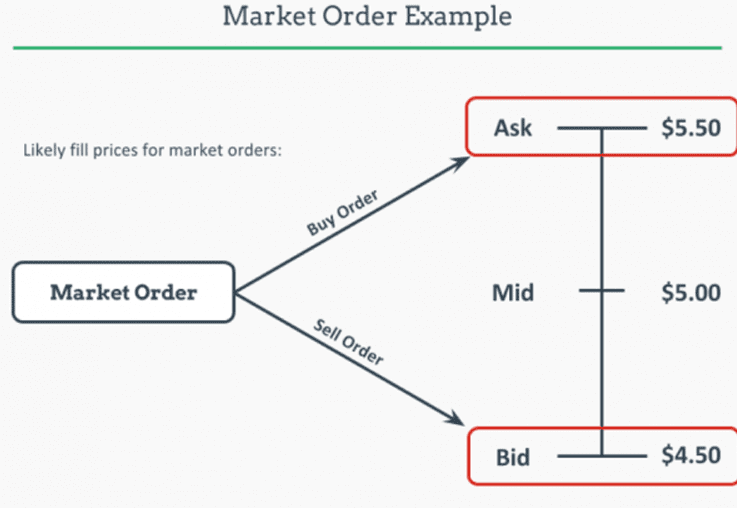

We specialize in optimizing option strategy trading, particularly focusing on options for trading. Our approach involves employing multi-leg premium collection strategies, which comprise two or more options contracts. Within these strategies, some contracts are sold (short) while others are held long to mitigate risk effectively.

Among the various option strategies utilized, vertical spreads, short straddles/strangles, iron condors, and butterflies are the most prominent. The choice of strategy depends on individual risk tolerance and prevailing market conditions. Our selection process for specific strategies and strike prices relies on thorough analysis, incorporating both technical and discretionary factors.

One of our preferred methods involves selling low delta 5 wide vertical spreads with a 3x stop, allowing the trade to unfold until either being stopped out or the spread expires worthless. Another popular approach is the Iron Condor strategy, wherein two spreads are sold simultaneously, each with the same 3x stop.

Have questions regarding trading? Reach out to us with your questions and queries